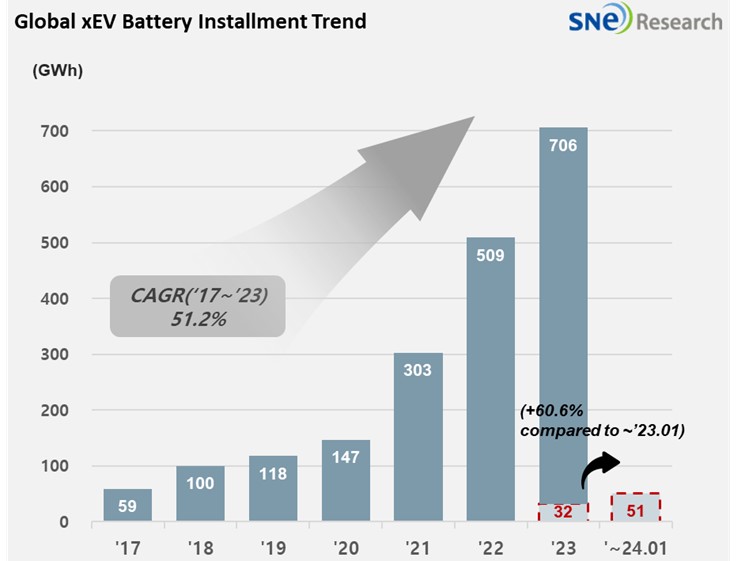

In January 2024, Global[1] EV Battery Usage[2] Posted 51.5GWh, a 60.6% YoY Growth

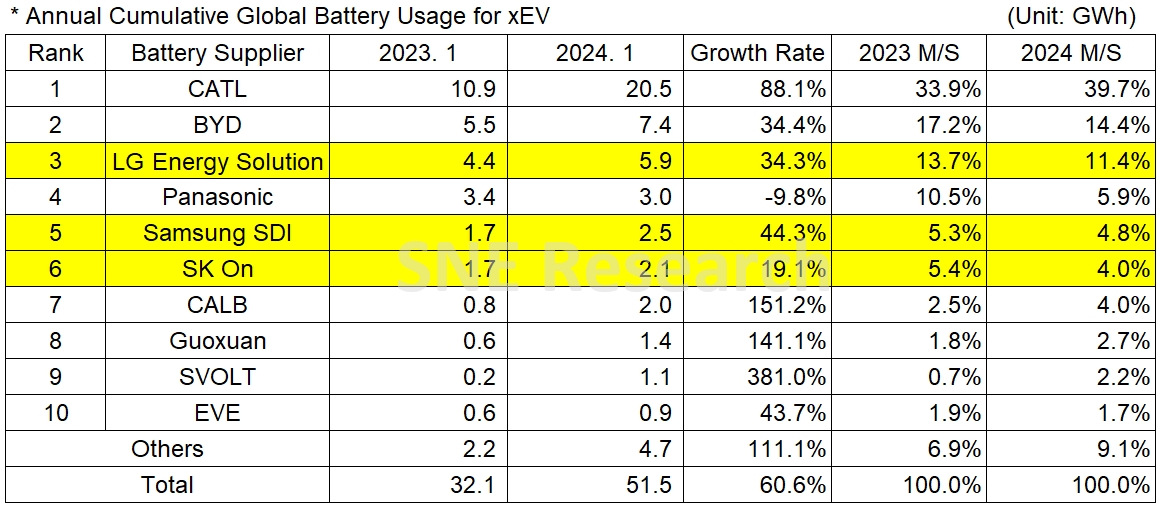

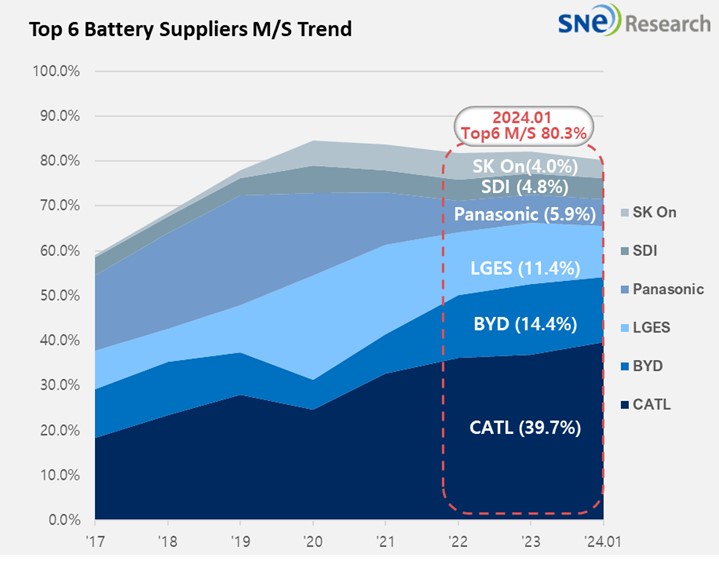

- In Jan 2024, K-trio’s M/S recorded 20.2%.

In January

2024, the amount of energy held by batteries for electric vehicles (EV, PHEV,

HEV) registered worldwide was approximately 51.5GWh, a 60.6% YoY growth.

(Source: 2024 Feb. Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 20.2%, declined by 4.2%p compared to the same period of last year, but the overall usage of K-trio battery still carried an upward momentum. LG Energy Solution ranked 3rd with a 34.3%(5.9GWh) YoY growth. While Samsung SDI ranked 5th with 44.3%(2.5GWh), SK On took the 7th place with 19.1%(2.1GWh).

(Source: 2024 Feb. Global Monthly EV and Battery Monthly Tracker, SNE Research)

The growth trend of K-trio was mainly affected by favorable sales of electric vehicle models equipped with batteries of each company as well as the increasing number of newly launched vehicles. Samsung SDI, recording the highest growth among K-trio, BMW iX/i4, continued its growth thanks to the solid sales of BMW iX/i4/i7, Audi Q8 e-Tron, and FIAT 500e in Europe as well as the sales volume Rivian R1T/R1S in North America. Samsung SDI, targeting the premium EV battery market, has continuously expanded the sale of high-value-added battery P5 and enjoyed stable demand from the market and high profitability. All of these allowed Samsung SDI to break the record-high sales amidst growing concerns about possible slowdown in the EV market growth. Samsung SDI announced that it has been implementing a strategy to internalize the production of cathode material through one of its subsidiary companies, STM.

SK On recorded a growth based on steady popularity of Hyundai IONIQ 5 and KIA EV 6 in the world, global sales expansion of KIA EV 9, and solid sales of Ford F-150 Lightning in the North American market. Together with the recent development of LFP battery by SK On, the battery maker has been reported that it received an order for battery used in Hyundai’s 2nd generation EV platform. In this regard, it is expected that SK On would see a rapid growth in Europe and North America.

LG Energy Solution also posted a growth led by favorable sales of Tesla Model 3/Y, Ford Mustang Mach-E, and GM Lyriq that are highly popular in Europe and North America. Although OEMs like Tesla, Ford, and GM have been increasing their installation proportion of LFP battery and uncertainties are prevalent in the market due to concerns about shrunken EV demand, LGES seems to be determined to get a competitive edge through accelerating the development of high-voltage, Mid-Ni NCM and LFP battery technology as well as mass production of 46xx series in earnest.

Panasonic, the only Japanese company in the top 10 on the list, recorded 3.0GWh in January 2024, ranked 4th on the list but it posted a 9.8% YoY degrowth. Panasonic, one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla Model Y in the North American market. As Panasonic is reported to unveil its advanced 2170 and 4680 cells, it is expected to expand its market share mostly focusing on Tesla.

CATL firmly captures the leading position in the global market based on an 88.1%(20.5GWh) YoY growth. In the Chinese domestic market, regarded as the world’s biggest EV market, CATL took up almost 40% of the market share by supplying its battery to major brands such as ZEEKR and Ideal as well as by supplying to global major OEMs such as Tesla Model 3/Y, BMW iX, Mercedes EQ Series, and VW ID Series.

BYD ranked 2nd in the global market with a 34.4%(7.4GWh) growth based on its high popularity earned in the Chinese domestic market. BYD has achieved price competitiveness through vertical SCM integration such as in-house battery supply and vehicle manufacturing. Recently, it has been rapidly expanding its share in the global market with an increased sales volume of Atto 3(Yuan plus), Atto 4(Seal), and Dolphin mainly sold in regions other than China.

(Source: 2024 Feb. Global Monthly EV and Battery Monthly Tracker, SNE Research)

The reason that the K-trio’s market share dropped significantly even with a 60.6% growth compared to the same month last year can be as follows: one, a seasonal decline usually observed in January, and two, the Chinese New Year holidays. In fact, the Chinese New Year has a tremendous impact on the decline in vehicle sales in China. While last year, the Chinese New Year was in January, it is in February this year. Taking this into consideration, it can be understood how the EV market growth in China recorded more than 90% while the EV sales growth was low in Europe and the US. These all led to a decrease in the usage of battery made by battery makers other then the Chinese makers. Even the China Passenger Car Association (CACP) also came up with a forecast that, due to the same reason, the EV sales in China showed a strong momentum in January, but it may go down to the bottom level in February. More precise market shares held by each company seem to be available after data from the 1st quarter is gathered.

In 2023, as the global EV market saw a slowdown in growth, talks about speed bumps in the road to vehicle electrification have been prevalent and sounded more plausible, making OEMs and battery makers closely watch what is happening in the US and Europe. In effect, Ford, GM, Renault, and VW all downsized their investments in electric vehicles or decided to postpone them. Then, it became inevitable for battery makers and battery material companies to joint their movements to hit the brakes and slow down their plans. OEMs, on the other hand, announced their new plans to increase the production of ICE vehicles, HEV, or PHEV models. Although the transition to electric vehicles is unavoidable in the mid to long-term, it is expected that hybrid vehicles such as HEV and PHEV may experience a short-term growth momentum.